For Immediate Release

Chicago, IL – January 17, 2022 – Today, Zacks Equity Research discusses AMN Healthcare Services AMN, Apollo Medical Holdings, Inc. AMEH and LifeMD, Inc. LFMD.

Industry: Medical Services

Link: https://www.zacks.com/commentary/1851984/3-medical-services-stocks-to-buy-despite-near-term-industry-woes

Since the onset of the COVID-19 crisis, with digital healthcare treatment becoming indispensable, the medical services industry has been witnessing significant demand for telemedicine-focused online medical and AI-powered technology services. Companies in the remote healthcare space have seen their stocks rally amid the economic volatility. AMN Healthcare Services, Apollo Medical Holdings, Inc. and LifeMD, Inc. are a few such stocks. The resurgence of COVID-19 cases has dealt a blow to the manual workforce and healthcare infrastructure as patients are once again deferring their non-essential procedures and hospital stay.

At the same time, with the highly contagious Omicron variant leading to rising COVID hospitalizations, hospital staffing shortages are being reported across the nation disrupting healthcare services. Further, COVID-19 has taken a staggering toll on the National Health Expenditure (NHE) plan, resulting in a massive commotion in terms of health care spending, utilization and employment trends.

Industry Description

The Zacks Medical Services industry comprises third-party service providers and caregivers appointed by core healthcare companies for economies of scale. The industry includes pharmacy benefit managers (PBM), contract research organizations (CRO), wireless MedTech companies, third-party testing labs, surgical facility providers, and healthcare workforce solutions providers among others.

Over the past years, this industry has strategically moved from volume- to value-based care. This changing pattern of care calls for advanced facilities, thus increasing the need to appoint specialized external service providers. With the growing importance of effective healthcare management, the medical service industry has become an integral part of the modern healthcare system.

5 Trends Shaping the Future of the Medical Services Industry

COVID-Led Procedure Disruption: The fast-mutating SARS-CoV-2 has raised questions about the sustainability of the ongoing economic rebound. Seeing the recent resurgence of cases nationwide in the form of Delta and Omicron, the non-COVID healthcare infrastructure is once again in the soup leading to a significant drag in their revenues.

At the same time, with continued COVID-19 led hospitalization, hospitals are currently running at excess capacity leading to enormous staff shortages. According to a Medical Device and Diagnostic Industry (MD+DI) report, the American Nurses Association recently reported to the Department of Health and Human Services that nursing shortages are being reported all over the country. MD+DI, in another report dated Jan 4, stated that “compared to a year ago, on average, about 16% of nurses and 12% of allied health professionals have left the respondents' respective facilities.”

Disruption in Healthcare Spending: Going by a Health Affairs report, CMS’ annual update to the National Health Expenditure Accounts (NHEA), released in December 2021, clearly showed that NHE increased 4.6% in 2019, showing a relatively stable trend of annual growth since 2016. However, this consistency was upended by COVID-19 beginning March 2020, resulting in massive short-term health sector spending and employment disruptions.

Digital Revolution Amid the Pandemic: With an increase in the adoption of digital platforms within the medical device space, remote monitoring, robotic surgeries, big-data analytics, 3D printing and electronic health records are gaining prominence in the United States. A 2020 Digital Health Market report suggests that this market, valued at $106 billion in 2019, will witness a 28.5% CAGR through 2026.

Other reports suggest that the companies that adopted artificial intelligence technologies witnessed a 50% reduction in treatment costs and experienced more than 50% improvement in patient outcomes. Amid the pandemic, this line of healthcare is becoming a major choice for contactless healthcare services.

Nursing Care Market Boom: With rising cognizance about the benefits of specialized medical caregiving, the need for healthcare workforce/staffing service providers has increased significantly. For example, the demand for nurses has increased manifold, driven by the rising incidence of chronic disorders in the United States and is expected to be high in the days ahead. Going by a report published by WFMJ, the U.S. nursing care market size is expected to be worth $460 billion in 2020 and witness a CAGR of 6% during 2020-2025.

New Technology Adoption: A reduction in regulatory and tax burden on U.S. healthcare companies is creating opportunities for mobile and wireless medical technology companies. This apart, treatments are becoming less invasive with shorter recovery times, thanks to the specialized skills and advanced techniques of surgical facility providers. Currently, third-party laboratory testing providers and CROs are also seeing a surge in demand, owing to the growing need for complex tests, services and clinical research.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Medical Services industry falls within the broader Zacks Medical sector. It carries a Zacks Industry Rank #206, which places it in the bottom 19% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

We will present a few stocks that have the potential to outperform the market based on a strong earnings outlook. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

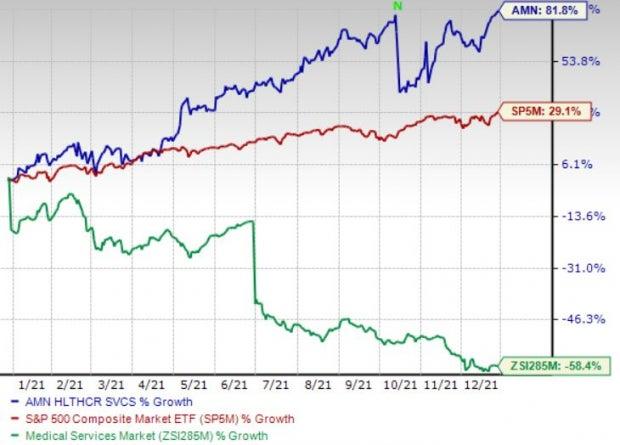

Industry Underperforms Sector and S&P 500

The Medical Services Industry has underperformed its own sector as well as the S&P 500 over the past year. The stocks in this industry have collectively lost 54.7% during the said time frame against the S&P 500 composite’s rise of 26.2%. The Medical sector has declined 15.8% in the same time frame.

Industry's Current Valuation

On the basis of forward 12-month price-to-earnings (P/E), which is commonly used for valuing medical stocks, the industry is currently trading at 16.29X compared with the S&P 500’s 21.59X and the sector’s 21.27X.

Over the last five years, the industry has traded as high as 30.14X, as low as 11.37X, and at the median of 15.95X.

3 Stocks to Buy Right Now

Below are three stocks within the Medical Services industry that have been witnessing positive earnings estimate revisions and carry a Zacks Rank of #1 (Strong Buy) or #2 (Buy), at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare Services: The company recruits and places nurses, physicians, and other healthcare professionals in travel or permanent assignments in acute-care facilities, physician practice groups, and other healthcare facilities. Per AMN Healthcare, increased healthcare utilization and a tight labor market have led to record high demand in several areas of the company’s business. This, in turn, bodes well for AMN Healthcare’s collaborations and innovations, which are intended to provide greater access to patient care, thus fueling further confidence.

AMN Healthcare’s long-term expected earnings growth rate is pegged at 16.2%. This Zacks Rank #1 company delivered an earnings surprise of 19.5%, on average, in the trailing four quarters.

Apollo Medical: The company is a physician-centric technology-powered healthcare management company, providing medical care services. Apollo Medical is registering growth across nearly all its businesses, particularly in risk pool settlements and incentives. The company is seeing solid organic membership growth in its existing IPAs leading to an increase in capitation revenues.

Apollo Medical’s long-term expected earnings growth rate is pegged at 20%. This Zacks Rank #1 company delivered an earnings surprise of 39.9%, on average, in the trailing four quarters.

LifeMD: This is a direct-to-patient telehealth company that connects consumers to healthcare professionals for care across various indications, including concierge care, men's sexual health, dermatology, and others in the United States. LifeMD is currently gaining from the launch of its virtual care platform and minimally dilutive financing.

The Zacks Consensus Estimate for LifeMD’s 2022 earnings and revenues indicates a year-over-year surge of 70.4% and 51.3%, respectively. The stock carries a Zacks Rank #2.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Join us on Facebook: https://www.facebook.com/ZacksInvestmentResearch/

Zacks Investment Research is under common control with affiliated entities (including a broker-dealer and an investment adviser), which may engage in transactions involving the foregoing securities for the clients of such affiliates.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

https://www.zacks.com

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. Zacks Investment Research does not engage in investment banking, market making or asset management activities of any securities. These returns are from hypothetical portfolios consisting of stocks with Zacks Rank = 1 that were rebalanced monthly with zero transaction costs. These are not the returns of actual portfolios of stocks. The S&P 500 is an unmanaged index. Visit https://www.zacks.com/performancefor information about the performance numbers displayed in this press release.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Click to get this free reportAMN Healthcare Services Inc (AMN): Free Stock Analysis ReportApollo Medical Holdings, Inc. (AMEH): Free Stock Analysis ReportLifeMD, Inc. (LFMD): Free Stock Analysis ReportTo read this article on Zacks.com click here.Zacks Investment ResearchThe views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.